What’s Next Resources

How to Get Started

Felicia Brown, Manager

Small Business Initiative, AARP.

https://blog.aarp.org/tag/be-your-own-boss

https://freelancing.aarpfoundation.org/registration

https://www.aarp.org/benefits-discounts/all/start-a-business/

Leaping Into Your What’s Next…

Download the Dreamleapers Presentation

Financing Your Dream

Curtis Archer, President

Harlem Community Development Corporation

https://esd.ny.gov/business-pandemic-recovery-initiative

https://hfls.org

https://www.harlemcommonwealth.org/hef

Pandemic Small Business Recovery Grant Program

The New York State COVID-19 Pandemic Small Business Recovery Grant Program was created to provide flexible grant assistance to currently viable small businesses, micro-businesses and for-profit independent arts and cultural organizations in the State of New York who have experienced economic hardship due to the COVID-19 pandemic.

Grant awards will be calculated based on a business’s annual gross receipts for 2019. Grant amounts and calculations are subject to change by Empire State Development. Interested parties should apply on ESD’s website.

The New York Forward Small Business Lease Assistance Partnership (LAP)

LAP is a partnership between Empire State Development, the nonprofit Start Small Think Big, and the New York Bar Association. The partnership is aimed at helping businesses throughout the state avoid evictions by providing commercial tenants and small business landlords with information and pro bono legal services needed to reach mutually agreeable lease renegotiations. Lease renegotiations are entirely voluntary, but strongly encouraged as outcomes can be beneficial for both parties. For tenets, rent relief would reduce financial stress, lower the chances of eviction, and improve business continuity. For landlords, renegotiations would lower vacancy rates, minimize litigation costs, and improve rent receipts.

Several options for lease renegotiations exist. Given that each lease agreement is unique, the option(s) that makes sense for a particular tenet-landlord relationship should be determined on a case-by-case basis. A non-exhaustive list of lease renegotiation options include the following: rent forgiveness, rent deferral, rent reduction, lease extension, profit sharing, profit-sharing with reduced base rent, delinquency fee forgiveness, and security deposit utilization. Additional information can be found on ESD’s website.

New York Forward Loan Fund (NYFLF)

New York Forward Loan Fund is a economic recovery loan program aimed at supporting New York State small businesses, nonprofits and small landlords as they reopen after the COVID-19 outbreak and NYS on PAUSE. NYFLF targets the state’s small businesses with 50 or fewer full-time equivalent (FTE) employees (90% of all businesses), nonprofits, and small residential landlords that have seen a loss of rental income.

NYFLF is providing working capital loans so that small businesses, nonprofits and small residential landlords have access to credit as they reopen. These loans are available to small businesses and nonprofits that did not receive a U.S. Small Business Administration Paycheck Protection Program of greater than $500,000 or an Economic Injury Disaster Loan (EIDL) for COVID-19 of greater than $150,000, and small landlords. The loans are not forgivable in part or whole. The loans will need to be paid back over a 5-year term with interest. Additional information is available on ESD’s website.

Economic Injury Disaster Loan Program

The Small Business Administration’s (SBA) Economic Injury Disaster Loan (EIDL) Program provides small businesses (500 employees or less) and nonprofits with low-interest loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing due to COVID-19. EIDL interest rates are 3.75% for small businesses and 2.75% for not-for-profits. As part of the COVID-19 relief effort, borrowers can also apply for an Emergency EIDL Grant from the SBA to request an advance on the loan of up to $10,000.

Shuttered Venue Operators

The SBA Shuttered Venue Operators (SVO) Grant program was established by the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act. The program includes $15 billion in grants to shuttered venues, to be administered by the SBA’s Office of Disaster Assistance. Eligible applicants may qualify for SVO Grants equal to 45% of their gross earned revenue, with the maximum amount available for a single grant award of $10 million. $2 billion is reserved for eligible applications with up to 50 full-time employees.

Columbia Emergency Loan Fund

The Columbia Emergency Loan Fund for Small Businesses is a relief program that disperses capital to assist small businesses struggling as a result of the coronavirus pandemic. Recent reports indicate that 40 percent of small businesses in New York, employing close to 3 million workers, could fail leaving nearly 1.5 million people without jobs. The Fund amplifies Columbia's commitment to support local employment by small businesses in Upper Manhattan.

Restaurant Revitalization Fund

The American Rescue Plan Act established the Restaurant Revitalization Fund (RRF) to provide funding to help restaurants and other eligible businesses keep their doors open. This program will provide restaurants with funding equal to their pandemic-related revenue loss up to $10 million per business and no more than $5 million per physical location. Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 11, 2023.

Restaurant Resiliency Program

This $25 million grant program will be managed by the NYS Department of Agriculture and Markets. It’ll provide funding to restaurants that choose to provide meals and food to people within distressed or under-represented communities. The grant can be used to cover the costs of food, preparation, and delivery of meals. Grant amounts and applications guidelines are currently being finalized and will be announced in the coming weeks.

Restaurant Return-to-Work Tax Credit

The $35 million Restaurant Return-to-Work Tax Credit Program provides an incentive to COVID-impacted restaurants to bring restaurant staff back-to-work, and to increase hiring at NYS restaurants. Qualifying businesses are eligible for a tax credit of $5,000 per new worker hired, up-to $50,000 per business. The Program is open to eligible restaurants located in New York City, or in an area outside of New York City that was designated an Orange or Red Zone for at least thirty consecutive day.

Kim Kaplan, Deputy Director

Hebrew Free Loan Society

HFLS is constantly looking for new partnerships and opportunities to make sure low- and moderate-income New Yorkers know they have a place to turn if they need access to flexible, affordable, safe capital - whether it's to start a business or to meet emergency expenses, pay medical bills, get an education, or meet any other type of financial need. Please don't hesitate to be in touch with any questions or if you see an opportunity for us to work together toward financial stability and opportunity for all, regardless of income.

From Dream to Venture Capital

Noa Ries and Kim Havens

Co-Founders of Kahilla

Kahilla is a digital platform that provides equitable access to effective leadership development.

Kahilla helps drive your productivity while achieving transformational behavior change through leadership development. Personal and professional development is a catalyst for growth, innovation, well-being, and productivity.

DREAMLEAPERS Shop

To support you as you pursue manifesting your dreams,

we are offering classes, workshops, books, and more.

Subscribe to DREAMLEAPERS now.

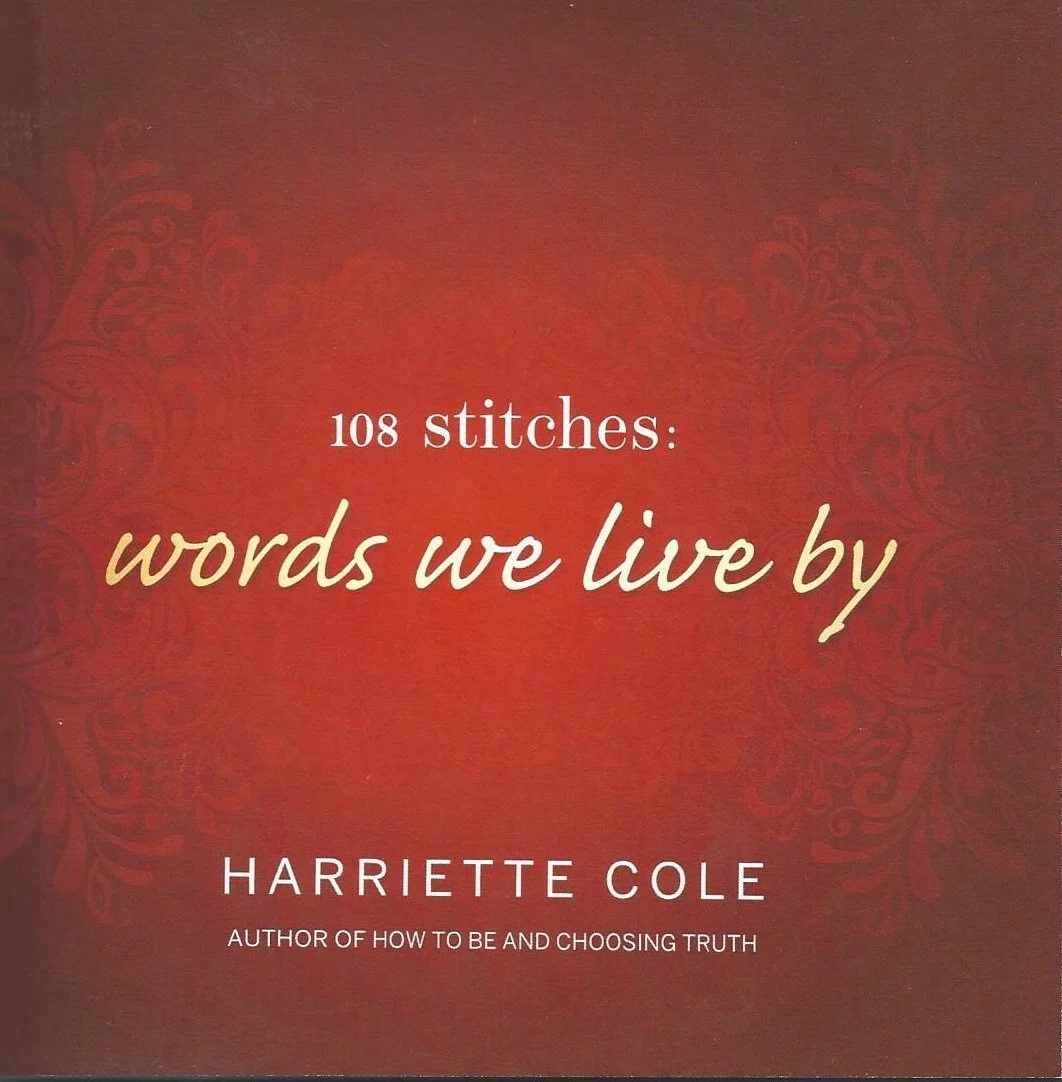

108 stitches: words we live by.

A book of meditations by Harriette Cole.